Why are investment reasons in SAP so important, and why do you make long-term capital investments? The key responsibility of management for stewardship and growth of an organization on behalf of stakeholders is to invest resources wisely for the future. Beyond day-to-day operating costs, this requires making longer-term, higher-value purchases in anticipation of future benefits to flow.

There are multiple demands for investment, and the drivers can be classified based on imperative (mandatory to discretionary), urgency (critical to non-urgent), alignment (strategic to operational), impact (replacement, optimization or enhancement), function (eg supply chain or IT) or stage (new or emergent). The reasons for investment will generally impact the required collaborators and approvers and is a useful dimension to allocating budget and analyzing the capital project portfolio.

This article explores the best practice approach to defining your reasons for investment that balances ease of use and depth of analysis. Specific considerations in the use of Investment Reasons within SAP Investment Management are identified, and the approach adopted by IQX CAPEX in mitigating these constraints is outlined.

Common Investment Reasons in SAP

Four typical investment reasons defined by organizations fall into the following broad categories:

1. Asset Replacement

The most common reason for capital expenditure is to repair or replace existing productive assets. Spare part inventories are often a sub-classification of asset replacement expenditure, and vital to keep productive plant and equipment operating. As the asset replacement budget is typically large (and preserved even in austere times), many project sponsors will attempt to classify their expenditure requests as asset replacement, where in fact the project may include a substantial amount of improvement, for example technology advancements. Consequently, asset replacement requests would typically require the requestor to include the original cost of the items to be replaced, so that the scale of the improvement can be assessed.

2. Compliance

A number of compliance related investment reasons may apply including regulatory compliance (as a result of new legislation), policy compliance (as a result of new ownership or management), or audit compliance (either internal or external). Compliance initiatives do not require a financial justification.

3. Financial Return

Investment initiatives that deliver a ‘financial return’ may be sub-classified into cost saving (productivity), revenue generating (leading to product improvement) or expansion (growth). These initiatives are always justified on the basis of a financial business case, and the comparison of key financial measures such as Net Present Value, Internal Rate of Return, or Payback period.

4. Strategic

The most important investment reason may be strategic. These investments are aligned to an organization’s longer-term strategic goals and may not deliver a direct financial return but be imperative to competitive positioning as part of an over-arching program. Often significant digitalization programs, innovation focus areas, or marketing investments may be subclassifications of a strategic investment. Under the direction of executive management, certain strategic initiatives may not require financial justification, but may be highly confidential, with access to view these initiatives closely restricted.

Using Investment Reasons in SAP

Assigning an Investment Reason to a budget pool, authorization for expenditure (AFE) request or individual investment measure (Internal Order or Project WBS) is very useful for the following four reasons:

1. Approval Workflow

If the reason for the investment is replacement or substantial maintenance of an existing plant asset, it would be normal practice for the maintenance manager to participate in the approval workflow. On the other hand, a strategic initiative may always route for review by the Chief Executive Officer for approval. Compliance initiatives would generally be routed through legal. Therefore, the classification of your investment reasons will be influenced by the required collaboration and approval workflow.

2. Budget Allocation

It is common practice for annual budgets to be apportioned at the highest level between compliance, asset maintenance (including spare parts), return (cost reduction or growth) and strategic initiatives. Sometimes special budget pools are provided for Information Technology or Environmental Health and Safety. Having a consistent definition of your investment reasons, assists with assignment of capital expenditure requests to these available investment program positions.

3. Control

There is a different level of risk and reward associated with investments of different types. Compliance initiatives are often mandatory. Maintenance spending is often essential. When budgets are constrained, organization will typically reduce their discretionary innovation or growth initiatives, despite the potential long-term consequence.

4. Analytics

For most organizations, capital expenditure reporting would include an analysis by investment reason. Over time, asset replacement expenditure should exceed the annual depreciation cost, or the organization’s asset base is being diminished. Failure to invest in growth and innovation will inhibit an organization’s expansion, even though cost-saving initiatives are providing a positive return on investment.

Classifying your Reasons for Investment in SAP

Seven dimensions to consider when defining your list of Investment Reasons to drive your data collection requirements and approval are outlined below:

1. Importance

Capital investment reasons can reflect imperativeness, for example mandatory (eg compliance), critical (e.g. replacement), mitigating (e.g. spares) or discretionary (e.g. return). Similar investment reasons may be broken down to reflect varying degrees of necessity. For example, ‘Preventative Maintenance’ investment may be viewed as ‘risk mitigating’, whereas ‘Emergency Replacement’ may be ‘critical’.

2. Urgency

Sometimes investment reasons are structured to indicate timing, with sub-classification to differentiate urgent from non-urgent expenditure. For example, strategic investment reasons may be classified into time-sensitive and ‘other’. Within SAP, investment program positions are also assigned a ‘Priority’, which is a better indication of urgency. Both reason and priority dimensions can work in concert to provide a high degree of analysis. Because of the availability of this additional attribute, it is normally not necessary to expand your taxonomy of investment reasons. Within IQX CAPEX, it is possible to set related attributes automatically: for example, ‘Compliance’ related investments, may automatically be assigned Priority ‘1’ to indicate urgency.

3. Strategic Alignment

A common classification of investment reasons includes a distinction between ‘business as usual’ versus ‘innovation’ style investments. Business as usual investment typically include asset replacement and normal expansion investments. For example, a waste management company adding another garbage collection truck, may be viewed more as ‘ordinary’ capital investment with predictable risk profile, compared to the same company installing solar panels to enhance its environmental credentials as part of a strategic initiative to meet an emissions target for competitive positioning (strategic objective).

4. Extent

There is often an important reporting distinction between investments related to like-for-like replacement, asset optimization (for example upgrading a key component) and substantial enhancements (Porsche for a Beetle). As asset replacement justifications are frequently employed by requesting site managers, care must be taken by management to ensure that substantial enhancements are fully justified (and may require a business case justification, unlike like-for-like replacements). Comparison of original and replacement value can be an objective indicator of the extent of change.

5. Scale

Occasionally, organizations will attempt to reflect the size of investment in the investment reason. For example, ‘major’ versus ‘minor’ asset enhancement. Within SAP, investment program positions are also assigned a ‘Scale’ dimension to indicate size, and this obviates the need to attempt to include this in the investment reason itself.

6. Function

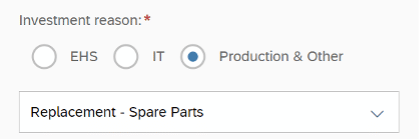

Investment Reasons can be usefully extended to support a functional distinction. For example, investment reasons may be grouped by Production, Environment Health and Safety and Information Technology. This can be a simple way of aggregating investments into areas of focus and responsibility across a large organization. Whilst SAP Investment Reasons are presented in a flat list, with IQX CAPEX, a tree of cascading drop downs can be configured to make the selection of the relevant reason easier. Normally, however, the functional nature of an investment is discernible by its assignment to an organizational unit (eg IT department) and the asset type (eg Intangible asset).

7. Investment Stage

A reason for investment may be to fund a new initiative, or to apply for additional funding because of emergent requirements. This distinction between new and supplementary funding requests can be accommodated within the investment reason classification to drive approval logic. For example, Maintenance ‘Base Construction’ versus ‘Construction Variations’. However, embedding investment stage will limit aggregated reporting based on the ‘real’ investment reason, unless replicated for every reason. With IQX CAPEX, it is possible to assign an additional dimension to a CAPEX request, for example Investment Type to distinguish Initial vs Supplementary funding requests and drive workflow accordingly. This avoids having to embed the project stage in the reason, and enables more effective investment analysis.

SAP Investment Management Reasons for Investment

When setting up SAP investment management, the following four items should be considered.

1. Persistence across objects

Investment Reason is available on Appropriation Requests, Program Positions and Investment Measures making it particularly useful for aggregated reporting. However, this persistence across transactions means it needs to be defined and applied with care.

2. One or Many

Often a particular investment may have multiple reasons – for example, an audit compliance initiative may also be cost saving. Within SAP, appropriation requests can have multiple investment reasons assigned with a corresponding percentage split. Other objects (positions and measures) can only hold a single investment reason. In practice, a single predominant investment reason normally applies, and makes reporting easier. With IQX CAPEX, it is possible to assign a secondary investment reason on a capital expenditure request for the information of approvers, even though a single reason is passed into the SAP object.

3. Numbering

The Investment Reason field in SAP is 2 characters wide allowing for a possible 1296 alphanumeric permutations. Structuring the reason codes with numeric logic does make grouping easier in standard SAP reporting. However, with IQX CAPEX it is possible to define logical grouping structure for ease of selection and reporting.

4. Restructuring your Investment Reasons

With SAP it is very difficult to restate your investment reasons retrospectively. If new reason codes are created the ‘old’ codes are still presented in SAP drop-down lists and need to be present for historical analysis. With IQX CAPEX, legacy reason codes can be mapped to current structures, and only relevant reasons ever displayed to end-users.

How to Better Manage Investment Reasons in SAP Investment Management

SAP Investment Management provides a standard attribute for managing your Investment Reasons that flows all the way through from budget Appropriation Requests, your Investment Program Positions and Investment Measures. Care must be taken in the initial setup of your system to ensure that this classification of Investment Reasons is appropriate to the capital management and reporting needs of the organization.

The simple selection list provided by standard SAP frequently results in a simplified configuration of this key attribute. Ideally, the classification of your Investment Reasons is comprehensive, yet intuitive to understand and use. IQX CAPEX is flexible enough to meet your unique classification requirements, whilst optimizing the end user-experience, to provide effective process automation, rich analytics and ultimately a higher return on your portfolio of capital investments.

Related Posts

If you enjoyed reading this, then please explore our other articles below: