The distinction between capital expenditure (CapEx) and operating expenditure (OpEx) may seem subtle, but understanding the difference between these expenditures is crucial towards the health of any organization. Both capital and operational expenditures involve spending money for the benefit of the organization. Complex expenditures may involve both types of expense, however the difference between CapEx vs OpEx can be confusing.

Despite the similarities, it’s crucial for the health of an organization to keep CapEx vs OpEx separated. The implication of misappropriating CapEx and OpEx can lead to anything from taxation issues to cash flow constraints. On the other hand, keeping each expenditure in their own well-defined role can help boost efficiency and streamline budgeting and forecasting.

Here is everything you need to know about CapEx vs OpEx.

What Is CapEx?

Capital expenditure, abbreviated as CapEx, is money invested to purchase, maintain, or upgrade assets to generate future revenue. For example, purchasing a new software platform or upgrading machinery on a plant floor would be considered CapEx. In order to quickly identify CapEx vs OpEx, let’s go through common examples of CapEx in business and finance:

Examples of CapEx

Listed below are 6 common examples of Capital Expenditure (CapEx):

- Property, Real-estate, and Office Buildings.

- Manufacturing Plants.

- Office Equipment and Manufacturing Equipment.

- Computers and Laptops.

- Software Licenses and Technology.

- Patents, Copyright, and Trademarks (Intangible Assets).

The Pros and Cons of CapEx

Capital expenditures or CapEx represent significant capital investments that are high value, substantial impact, and high risk. On the positive side, CapEx fuels business expansion and ensures long-term viability; fostering growth and sustainability. On the negative side, poorly chosen CapEx ventures can detrimentally affect the business, leading to wasted resources and difficult-to-reverse decisions, thus emphasizing the importance of strategic planning and effective capital planning.

How to Calculate CapEx

Determining capital expenditure enables organizations to identify the investment allocated to acquiring or improving long-term assets. The result of the CAPEX formula reveals the net change in Property, Plant, and Equipment (PP&E) plus the expense of depreciating assets. The CapEx formula is simplified below:

CapEx = Ending PP&E – Beginning PP&E + Depreciation Expense

Due to the high-stakes nature of the CapEx formula and CAPEX calculations, an organization must understand the CapEx process. The CapEx process is long and complex, but it can be streamlined. Learn more about the CapEx formula here.

The CapEx Process

- Project proposals are created and considered in preparing an annual capital expenditure (CapEx) budget.

- Detailed business cases are prepared and submitted as Capital Expenditure Requests (CER’s) for approval.

- Depending on their value and motivation, authorization for expenditure (AFE) requests may require multiple levels of individual and panel approval.

- Supplementary budget funding may be requested based on forecast expenditures once a capital project is approved.

- On completion of a capital project, the accumulated costs are settled to a fixed asset, and any unused budget is returned to the funding pool for redeployment.

- Post-investment reviews evaluate project outcomes and improve future project definition and selection.

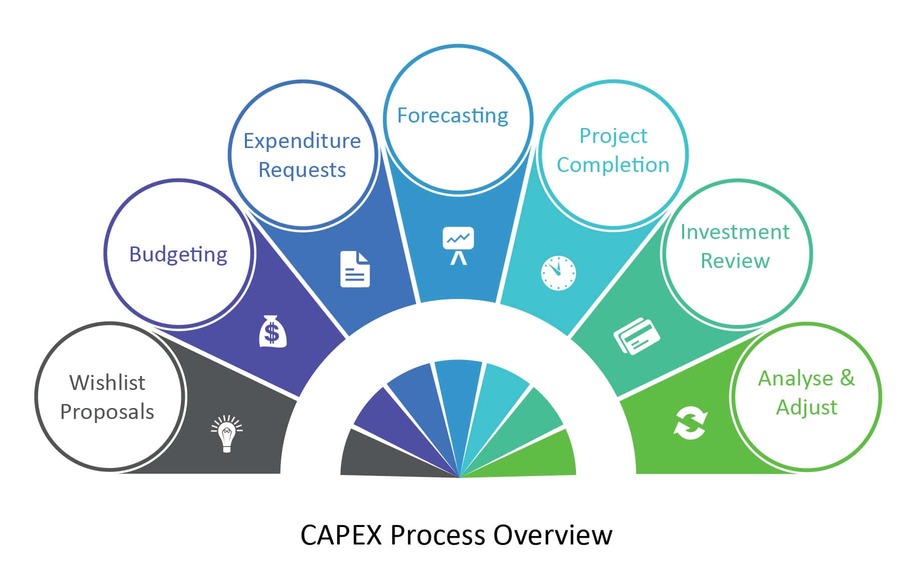

To emphasize the importance of distinguishing CAPEX vs OPEX, this diagram displays the entire Capital Expenditure Management Process:

This diagram of the CapEx Process displays the key stages of the capital expenditure (CapEx) management process, and the interaction with follow-on CapEx activities.

What Is OpEx?

Operating expenditures (OPEX) are the day-to-day expenses that businesses must pay to keep the organization running. OPEX include expenses such as employee wages, equipment rentals, laptops, utilities, and office supplies. While CAPEX is intended to increase the long-term value of the business, OPEX is about keeping the lights on and to maximize business productivity. So that you can quickly identify CAPEX vs OPEX, let’s use the diagram below.

Examples of OpEx

Operating expenses (OpEx) are the ongoing costs for running a business. Here are ten common examples of OpEx:

- Salaries and Wages: Expenses for employees, benefits and payroll taxes.

- Rent: Expenses for leasing office space, warehouses, or manufacturing plants.

- Utilities: Expenses for electricity, water, gas, and other utilities.

- Office Supplies: Expenses for laptops, paper, pens, and printer ink.

- Maintenance and Repairs: Expenses for maintaining equipment and facilities.

- Marketing: Expenses for marketing and promotional activities.

- Software Subscriptions: Expenses for using software licenses and services.

- Insurance: Expenses from premiums for property, liability, and health insurance.

- Travel: Expenses from employee business trips and travel.

- Research and Development (R&D): Expenses towards research and development.

CapEx vs OpEx Examples

If a manufacturing company enters into a monthly operating lease for new machines, the monthly repayment is classified as OpEx. Although, if they decide to purchase new machines outright, that investment is classified as CapEx. OpEx are short-term, variable, and lower-risk, whereas CapEx are long-term and high-risk investments aiming to benefit the company in the future.

CapEx vs OpEx Key Differences

The 4 key differences between CapEx vs OpEx is with how they affect a company’s financial statements and asset accounting, the nature of investment, the impact on taxes, and the benefits. So, let’s explore core distinctions between CapEx vs OpEx:

-

The Nature of Investment

CapEx encompass investments directed towards long-term assets with the objective of facilitating future revenue generation. This often involves actions like acquiring property, purchasing equipment, or implementing substantial enhancements to existing assets. On the other hand, OPEX represents the ongoing expenses essential for sustaining daily business operations and facilitating revenue generation. These include costs like salaries, utility bills, rent payments, and insurance premiums. While CAPEX focuses on strategic investments for future growth, OPEX pertains to the essential day-to-day costs incurred to maintain business functionality and drive current revenue streams.

-

Financial Statements and Accounting

CAPEX are recorded as assets on the balance sheet and are typically depreciated or amortized over their useful life. They do not immediately impact the income statement. OPEX, however, are expensed on the income statement in the period in which they are incurred, directly affecting profitability.

-

Impact on Taxes

CAPEX may offer tax benefits through depreciation or amortization deductions over time, reducing taxable income gradually. Conversely, OPEX are typically fully deductible in the year they are incurred, potentially reducing taxable income for that specific year.

-

The Business Benefits

CAPEX provide long-term benefits and contribute to business growth and revenue by investing in assets that enhance operational capabilities or expand market reach. On the other hand, OPEX are necessary for day-to-day operations but do not directly contribute to long-term growth, as they primarily cover expenses incurred in sustaining current business activities and generating immediate revenue.

The differences with CAPEX vs OPEX is critical to understand, so it’s crucial to summarize this distinction. CapEx involves investments in long-term assets with benefits realized over time, whereas OpEx represents day-to-day expenses necessary to sustain daily business activities.

The Importance of Classifying CapEx vs OpEx

There’s no denying that the CAPEX process can be complex and drawn out. So it’s no surprise that businesses try to blur the line between CAPEX vs OPEX to put more expenditures in the latter category. But the two types of expenditures have very different effects on the organizations capital budgeting, reporting and bottom line.

Operational expenditures are generally tax deductible, provided they are “ordinary and customary costs” to keep the business running. Whereas capital expenditures are not immediately deductible expenses, but can be depreciated over time to offset the investment cost. OPEX are listed as an expense and reported on the business’ income statement, while CAPEX are listed as assets and reported on the balance sheet. The impact on financial statements is a key difference in CapEx vs OpEx.

Confusing or conflating the two can make it harder for the business to get a clear picture of its own assets and expenses—which can be especially problematic for tax purposes. Granted, any new investment initiative may include CAPEX and OPEX components. Let’s identify the benefits of analysis of CAPEX vs OPEX.

How to Implement an Effective CapEx Process

The solution to an overly convoluted CAPEX process is not to classify as many expenses as OPEX as possible. Instead, the goal should be to streamline CAPEX to reduce bottlenecks, increase speed and enable smarter decision making. Distinguishing the difference between CAPEX vs OPEX will inevitably make your budgeting process more efficient.

It may seem daunting to overhaul your organization’s CAPEX process. It is a multi-departmental, multi-stage affair with plenty of stakeholders to appease; but it can be done.

Start by seeking to simplify the tech stack that underlies the process. If each department has its own proprietary platform for their piece of the puzzle, there’s plenty of room for improvement.

An end-to-end CAPEX solution with effective project controls will:

- Enable seamless communication between teams.

- Drive business collaboration.

- Reduce approval bottlenecks.

- Simplify and shorten the CAPEX process.

- Seamlessly identify CapEx vs OpEx.

- Provide financial data and insights to optimize the next CAPEX cycle.

In addition, the right solution can automatically identify CAPEX vs OPEX on a single platform.

While CAPEX and OPEX are both essential parts of keeping a business operational and growing, CAPEX has traditionally been the slower and more painful process of the two. With the right solution and new processes, however, modern CAPEX can be far more streamlined and efficient. Moving onwards with a dynamic business environment, use the guide below to explore the concepts and insights into modern CAPEX management.

Related Posts

If you enjoyed reading this, then please explore our other articles below: