Integrate Project Portfolio Management, Budgeting, and Approvals

Finance teams are under increasing pressure to decide which capital projects to fund, when to fund them, and how to allocate limited financial and human resources in line with strategic priorities. These decisions are often made with incomplete information, inconsistent business cases, and limited visibility across competing demands.

This page focuses on the front-end of capital planning; from project intake and business case evaluation through portfolio selection and approval, before projects are created in SAP.

Stratex Online is used by organizations worldwide to manage complex capital portfolios.

What Improves When Front-End Capital Planning Is Structured

For organizations managing constrained capital budgets,

the biggest gains come from improving decision quality before projects begin.

Capital Is Allocated

to the Right Projects

When capital demand is captured consistently and evaluated against clear criteria, organizations can prioritize initiatives that best align to strategy and funding constraints. This reduces spend on low-value projects and improves confidence that capital is being directed where it will have the greatest impact.

Decisions Are Made Faster,

Without Losing Control

Replacing spreadsheet-based comparisons and email-driven approvals with a structured decision process enables faster evaluation and prioritization. Finance and governance teams gain visibility across competing initiatives, while automated workflows ensure decisions progress without sacrificing rigor or oversight.

Governance Is Applied

Before Capital Is Committed

Applying governance at the front-end, through standardized business cases, risk assessment, and approval thresholds, reduces downstream rework and late-stage intervention. Issues are identified earlier, approvals align with delegation of authority, and fewer surprises emerge during execution.

Integrate Project Intake and Project Demand Management

Create a controlled entry point for capital initiatives by standardizing how project requests are captured across the organization. A structured intake process gives finance early visibility of demand and ensures initiatives are assessed in the context of funding constraints and strategic priorities.

Linking project intake to strategic objectives enables clearer differentiation between discretionary requests, mandatory investment, and strategic initiatives before capital is provisionally allocated.

Consistent scoring and evaluation criteria support objective comparison across competing demands, while defined escalation thresholds ensure urgent or high-impact initiatives receive prompt management attention.

Customer Insight

Makame Tajbakhsh, Site Controller, Alcon

Standardized Project Intake: Provides early visibility of capital demand

and supports consistent evaluation across proposed initiatives.

Drive Informed Decisions with Business Case Evaluation

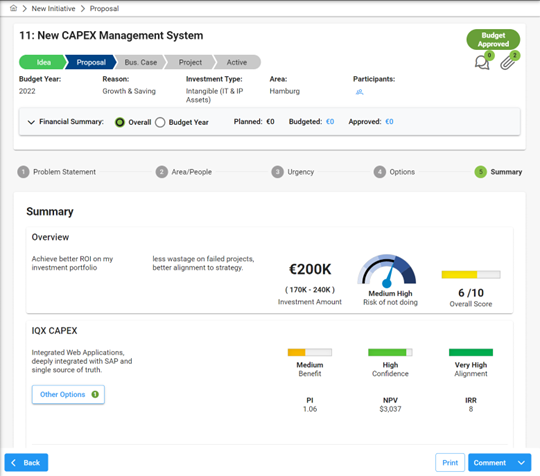

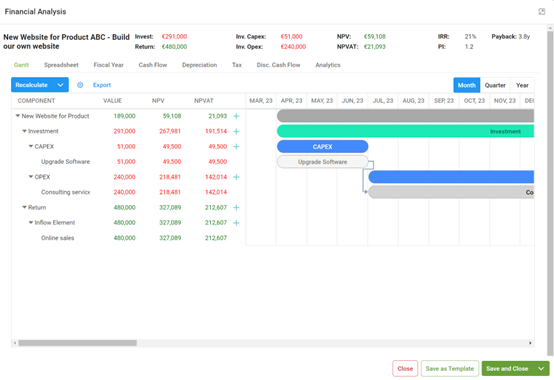

Business case evaluation provides a structured basis for capital investment decisions.

A standardized business case ensures proposed initiatives are assessed consistently, supporting objective comparison across competing demands and improving confidence in funding recommendations.

Stratex Online provides a consistent business case structure to capture project justification, classification, and financial inputs required for evaluation.

Core financial measures, including payback period, net present value, and internal rate of return, support transparent comparison across the portfolio. Combined with qualitative criteria and an overall evaluation score, this creates a defensible basis for project prioritization and portfolio-level decision-making.

Customer Insight

James Brandon Pittman, Project Manager

Standardized Financial Metrics: Enable objective comparison of

competing investment options across the capital project portfolio.

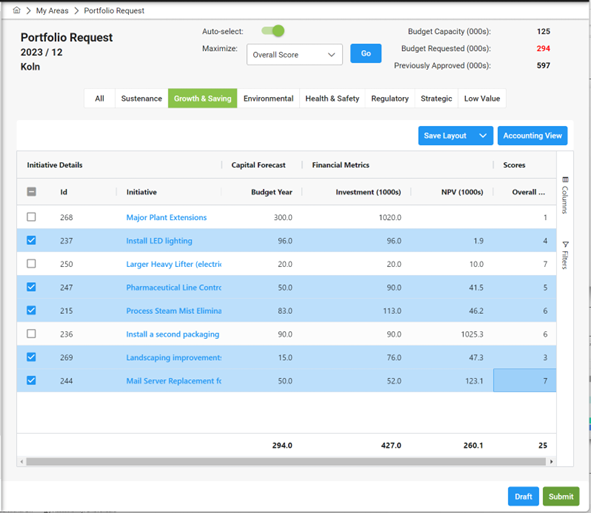

Maximize Success with Project Portfolio Management and Budgeting

Project portfolio selection translates individual business case assessments into an enterprise-wide view of capital allocation. At this stage, initiatives are compared collectively to understand relative value, interdependencies, and funding impact across the portfolio.

Stratex Online supports this process by providing a structured portfolio view where initiatives can be compared using consistent prioritization criteria and funding constraints. This enables finance teams to test alternative investment mixes and understand the implications of portfolio-level decisions before budgets are finalized.

By linking portfolio selection back to underlying business case evaluations, organizations can allocate capital with a clear, auditable rationale and maintain transparency across portfolio decisions.

Customer Insight

Makame Tajbakhsh, Site Controller, Alcon

Portfolio-Level Capital View: Portfolio-level views support

capital allocation decisions under constrained budgets.

Seamless Capital Expenditure Requests and Approvals

Capital expenditure requests formalize the decision to commit funding to approved initiatives. This stage applies governance and delegation of authority to ensure capital commitments are reviewed, approved, and documented in line with policy before execution begins.

In SAP environments, this step is commonly referred to as an Authorisation for Expenditure (AFE) or Request for Approval or Appropriation (RFA), and represents the point at which portfolio decisions are converted into approved capital commitments.

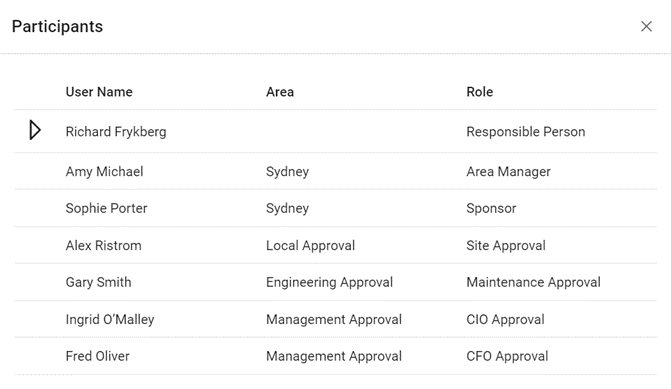

Stratex Online supports a structured approval process that provides clear visibility into approval status, funding commitments, and decision accountability across the portfolio. Consistent approval thresholds and controlled routing help reduce ambiguity and maintain alignment with financial governance requirements.

This ensures capital is released in a controlled, auditable manner, with transparency over who approved what, when, and under which authority.

Customer Insight

Michael Register, Project Manager

Capital Approval Controls: Capital approvals enforce

governance and accountability before funds are committed.